Why invest in YIT? Read more about YIT as an investment.

- Investors

- YIT as an investment

- Acquisitions and disposals

Acquisitions and disposals

YIT's history and acquisitions

YIT's historyYIT's history

Major acquisitions and disposalsMajor acquisitions and disposals

- Sale of the subsidiary providing in-house equipment services to Renta Oy in 2024

- Sale of the renewable energy business to Eolus Vind AB in 2023

- Sale of Russian businesses to Etalon Group PLC in 2022

- Sale of Nordic paving and mineral aggregates businesses to Peab in 2020

- Merger of YIT Corporation and Lemminkäinen Corporation in 2018

- Demerger where YIT's Building Systems business was transferred to a company established in the demerger named Caverion Corporation in 2013

20242024

Sold businesses

The sale of YIT Kalusto Oy, the company's subsidiary providing in-house equipment services, to Renta Oy.

Stock Exchange Release on 9 January 2024

20232023

Sold businesses

The sale of YIT Energy Oy, the renewable energy business, to Eolus Vind AB.

Stock Exchange Release 5 December 2023

20222022

Sold businesses

The sale of the Russian businesses to Etalon Group PLC was closed on 30 May 2022.

Stock exchange release 30 May 2022

2020

Sold businesses

The sale of the Nordic paving and mineral aggregates businesses to Peab was closed on 1 April 2020.

Stock exchange release 1 Apr 2020

2018

Merger

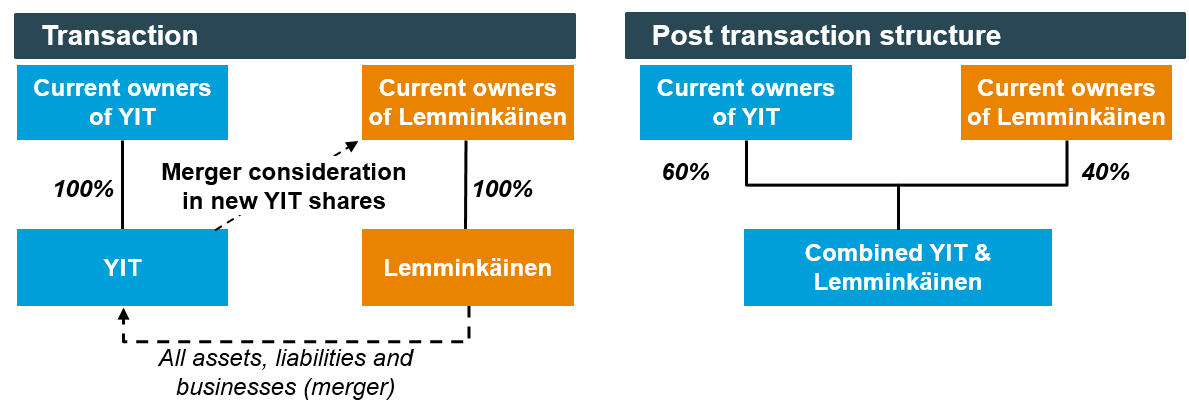

The merger of YIT Corporation and Lemminkäinen Corporation took effect on 1 February 2018.

Stock exchange release 31 Jan 2018

Additional information

The combination was implemented as a statutory absorption merger whereby Lemminkäinen was merged into YIT.

The Extraordinary General Meetings (each, an “EGM”) of YIT and Lemminkäinen held on 12 September 2017 approved the merger.

Further information about resolutions passed at the Extraordinary General Meetings on 12 Sep 2017

The Finnish Competition and Consumer Authority (the "FCCA") announced on 16 January 2018 that it would approve the merger between YIT and Lemminkäinen as such. On 26 January 2018, the FCCA gave its final approval decision for the merger.

Stock exchange release 16 Jan 2018

Stock exchange release 26 Jan 2018

Presentations

Merger Merger prospectus/Offering circular Merger prospectus/Supplement to offering circular Merger plan

Merger announcement Presentation

Pro forma financial figures

Acquisition cost

Further information about the acquisition cost of Lemminkäinen shares converted as YIT shares.

The acquisition cost of Lemminkäinen shares converted as YIT shares

The acquisition cost of shares acquired as merger compensation is considered equal to that of pre-merger shares per acquisition. This means that the acquisition cost of YIT shares acquired as merger compensation is determined by the old LMK shares’ acquisition tranches. In terms of volume, the YIT shares acquired as merger compensation should be proportioned to each LMK share acquisition tranche. The acquisition cost for each YIT share is calculated on the basis of the corresponding LMK share acquisition tranche at the time of acquisition. When calculating the acquisition cost of shares acquired as merger compensation, the ratio by which LMK shares were compensated for with YIT shares should be taken into account.

Using an assumed cost of acquisition instead of actual cost will only become relevant when shares are handed over and the resulting profit from assignment is taxed. At such a time, a shareholder may instead of the actual acquisition cost subtract an assumed cost from the sale price (20% or 40% in case the share ownership has lasted for more than 10 years). If actual acquisition cost is used, the taxpayer must themselves present the Tax Administration with the original acquisition cost, on the basis of which the YIT share acquisition cost can be calculated. In practice, it is sensible to use an assumed cost if this results in a taxable profit from assignment that is lower than using the actual and already paid acquisition cost would.

When selling YIT shares acquired as merger compensation, the “first in, first out” principle is applied, meaning that shares are considered as handed over in their order of acquisition. An exception to this rule is made when a shareholder has shares in various book-entry accounts and can indicate from which account the shares have been sold.

Lemminkäinen's material

The section includes Lemminkäinen Corporation's reports and releases to the end of January 2018. Since the 1 February 2018 merger with YIT Corporation, the company reports under YIT Corporation.

| Financial reports | Governance | Other materials | Releases |

|

Lemminkäinen's Financial statements for Jan 2018 Interim and half-year reports and financial statements bulletins

|

Other presentations | Lemminkäinen's releases |

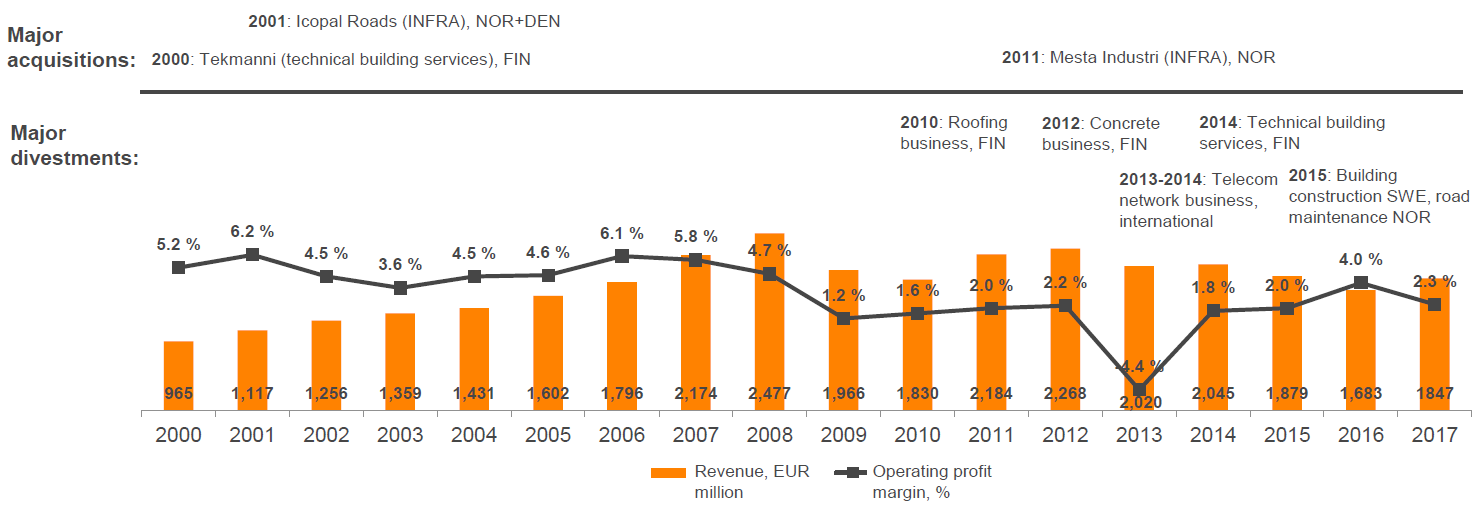

Lemminkäinen in 2000-2017

2017

Acquisitions

YIT acquired a majority stake in Projektipalvelu Talon Tekniikka Oy (industry: housing company renovation) in Finland in 2017.

Investor news 20 Dec 2017

20142014

Acquisitions

YIT increased its holding in its Slovakian subsidiary YIT Reding from 70 per cent to 100 per cent.

Investor news 21 Nov 2014

2013

Acquisitions

YIT increased its holding in YIT Moskovia by 5.92 percentage points and now holds all of the shares in the company. The purchase

price was EUR 5.1 million.

Demerger

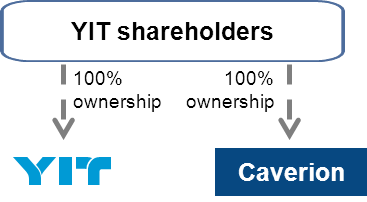

In 2013 conducted a partial demerger where YIT's Building Systems business was transferred to a company established in the demerger named Caverion Corporation.

Additional information

The implementation of the demerger was registered with the Finnish Trade Register on 30 June, 2013 and, therefore, all of the assets and liabilities related to YIT's Building Systems business were transferred to a company established in the demerger named Caverion Corporation (“Caverion”).

Following the implementation of the demerger, Caverion Corporation is an independent public limited company, separate from YIT Corporation. Before 30 June 2013, in YIT’s financial reporting, Caverion’s business was disclosed as a separate line item under discontinued operations with the exception of the balance sheet. The balance sheet was not adjusted in the official comparative information compliant with IFRS; rather, it also included the items associated with the Building Services business, thus corresponding to the previously reported balance sheet of YIT Corporation. Due to this, the balance sheet disclosed as comparative information does not, in this respect, illustrate the financial position of the continuing operations.

Further information about the resolutions passed at the Extraordinary General Meeting 17 Jun 2013

Materials

Registration Document and Demerger Note and Summary relating to the partial demerger

Registration document

Demerger Note and Summary

Supplement to Demerger Circular (27 Jun)

Supplement to Demerger Circular (1 Jul)

Marketing brochure relating to the partial demerger

Marketing brochure

Offer memoranda relating to the floating rate bond tender offer

Offer Memoranda

Demerger plan

Attachment to the Stock Exchange Release on 21 Feb

Report of Organisational Actions Affecting Basis of Securities in the USA

US Form 8937

Acquisition cost of YIT Corporation and Caverion Corporation

Read more about determination of acquisition costs of the shares for Finnish taxation purposes.

Determination of acquisition costs of YIT and Caverion shares for Finnish taxation purposes

YIT's Building Systems business was transferred to Caverion Corporation in a partial demerger of YIT on 30 June 2013 and YIT’s shareholders received Caverion shares as demerger consideration (1:1). Due to the partial demerger the original acquisition cost of YIT shares is divided between YIT and Caverion shares in the Finnish taxation. The acquisition cost depends on the original acquisition date. Determination of the acquisition costs is necessary for the Finnish taxation purposes in order to calculate a capital gain or loss from a sale of shares.

Large Taxpayers’ Office has from their side confirmed to YIT that the original acquisition cost of YIT share is divided between YIT and Caverion shares based on the ratio of net assets.

YIT’s net assets were divided between YIT and Caverion in the partial demerger as follows:

- 77.37% stayed at YIT and

- 22.63% was transferred to Caverion

Example: If a shareholder purchased a YIT share before the partial demerger for a price of EUR 15.00, after the partial demerger the acquisition cost of YIT share is EUR 11.61 (77.37%) and Caverion share is EUR 3.39 (22.63%).

The above description of the determination of the acquisition costs is not applicable to non-Finnish resident shareholders. We recommend that shareholders who are tax resident outside Finland will seek advice from their own tax advisors or local tax authorities in order to determine the acquisition costs of the shares for their taxation purposes.

Determination of the acquisition cost for Finnish taxation purposes

In the Finnish taxation the original acquisition cost of YIT shares is divided between YIT and Caverion shares received as a demerger consideration based either on the ratio of the distribution of net assets of the companies on demerger date or on the ratio of the current values of the shares. The current value ratio is used if the distribution ratio of the net assets materially differs from the current value ratio.

The ratio of the current values of YIT and Caverion shares did not materially differ from the distribution ratio of the net assets. Therefore, the acquisition costs of the shares are determined according to the main rule, i.e. according to the distribution ratio of the net assets.

Previous acquisitions

Major acquisitions executed in 2000-2012 are related to YIT's Building Services business which was transferred to the company formed in the 2013 demerger, Caverion Corporation.